How to Pay Yourself $2.1 Million in Taxes

Tax refunds are tantamount to loans to the government, repaid a few weeks or months late. But many people treat their tax refunds as a windfall — found money, to be spent on whatever extra-budgetary items they desire, much like an unexpected Christmas bonus or winning lottery ticket. Easy come, easy go.

But mix in carelessness and greed? It can also end up with a jail sentence.

The story starts in January 2012, in Oregon. A 25-year-old woman named Krystie Marie Reyes filed her state tax returns using TurboTax, a self-directed piece of accounting software. She had a very good year, according to the information she provided to the government via TurboTax — she earned $3 million. But the Oregon government wasn’t about to get a big tax windfall. As Reyes navigated through TurboTax’s forms and checkboxes, she found a lot of deductions, credits, and similar ways to reduce her tax liability. When she was done, she found out that her tax bill for the year was $0, and even better, she had somehow overpaid a bit. She was entitled a tax refund of $2.1 million.

The information Reyes provided was, of course, wrong — perhaps an accident, perhaps fraud, but in either case, complete and utter fiction. (Her actual earnings that year were in the realm of $15,000, according to the Oregonian.) In almost all cases, there’d be no actual harm from her errors — a tax return so clearly erroneous would be rejected by the state agency. In fact, that almost happened in this case, too. The Oregon Department of Revenue’s internal systems noticed that something was off and flagged the return for further investigation. But human error stepped in. A state spokesperson told the New York Daily News that agency “manually reviewed it and our internal controls failed. Someone did approve a $2.1 million refund.”

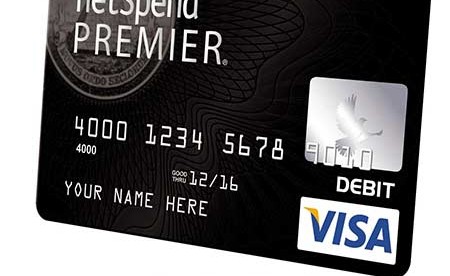

Had Reyes simply deposited her refund check into a savings account, maybe the story would have ended there, and with her a millionaire. (Maybe not, though, as “Know Your Customer” banking regulations may have tripped another failsafe.) Instead, she took advantage of another TurboTax offering, one which puts your tax refund on a prepaid debit card — even if the amount in question is absurdly high. In mid-February of that year, TurboTax received Reyes’ tax refund and added the $2.1 million balance to a previously-issued card. Reyes went on a spending spree, buying $150,000 in various items. (She didn’t buy a fancy new car, though; instead, she paid down her lease on her 1999 Dodge Caravan and outfitted it with new tires and wheels for another $800.) And because the Oregon taxing agency had approved the refund, no one thought to give any of this a second look.

Until Reyes asked them to.

Reyes, potentially hoping to reclaim some of her spent millions, told TurboTax that her card was missing — she had either lost it or it was stolen, according to NBC News. (Other articles say that she had reported a different card as lost, and still others say that she twice reported the first card as lost, but few think she actually lost her multi-million dollar debit card.) The re-issuance of that large amount of cash set off the otherwise-dormant alarm bells, and this time, there was no human error. Reyes’ attempts are fraud — at the time, the largest amount ever swindled that way in Oregon — were finally uncovered.

Reyes pled guilty to theft and was sentenced to five and a half years in prison.

Bonus Fact: If a taxpayer pays too much in taxes — that is, if he or she pays more than the law requires — the government sends back the overage as a refund, as discussed above. But what happens when the government collects the right amount from individuals, but in total, more money than its budget estimates suggested it would? In most cases, the government keeps it for a rainy day, so to speak. Not so in Oregon. In 2000, voters amended the state constitution to require a state-wide rebate if the government collected more than 2% more money than expected. When triggered, though, per capita rebates are only in the $100 range, not the $2.1 million one.

Bonus Fact: If a taxpayer pays too much in taxes — that is, if he or she pays more than the law requires — the government sends back the overage as a refund, as discussed above. But what happens when the government collects the right amount from individuals, but in total, more money than its budget estimates suggested it would? In most cases, the government keeps it for a rainy day, so to speak. Not so in Oregon. In 2000, voters amended the state constitution to require a state-wide rebate if the government collected more than 2% more money than expected. When triggered, though, per capita rebates are only in the $100 range, not the $2.1 million one.

From the Archives: Thermonuclear War and Taxes: If the world is about to end, will the IRS still make you pay your tax bill? Of course they will.

Take the Quiz: Can you name the countries with the highest top income tax rate?

Related: An out-of-date version of TurboTax, in case you want to try and get yourself one of those seven-figure refunds. Not advised, as it may come with a jail sentence.