The $91-Per-Square-Foot Very Tiny Estate

The home pictured above is of a duplex in Tamarac, a city in Broward County, Florida. The image itself comes from Google Maps, albeit indirectly — if you go look at it now (click here), you’ll see a different color car, a different color trash can, and that the American flag is missing. The image itself, as the timestamp notes, is from more than five years ago. It comes from the website of a Broward County property appraiser — you can, and should click here to see for yourself.

The reason the property pictured above is on that website? If you don’t pay your property taxes in Broward County, sooner or later, the government is going to seize it. Once a month, the county auctions off such properties in an effort to recoup the taxes owed. The property seen above — parcel 494105-15-1371 — was one such property. It was placed on the auction block on March 20, 2019, with a starting bid of $2,106.06. Those interested in bidding were directed to the property appraiser’s website, which housed the most recent tax information for the property. You can find that here, and if you click “Photographs” on the menu bar, you’ll be taken to the page with the picture republished above.

A bit of research into the homes shown above would have you conclude that the property is worth a lot more than $2,000 or so — for example, the home on the right, per Zillow, is worth north of $200,000. The auction started at 1% of that, which sounds like something too good to be true. The four people who bid on the property — here are the complete auction results — probably thought they had the steal of the century on their hands. Three, though, went home empty-handed. The fourth, a man named Kerville Holness, won the auction with a high bid of $9,100.

And then he found out what he bought.

If you look again at that tax info sheet, there are a few clues. The property has an assessed value of $50. The tax owed the property in 2018 was $1.06, up a penny from the year prior. And while not abundantly clear, toward the bottom right, the document appears to suggest that the property was only 100 square feet in area.

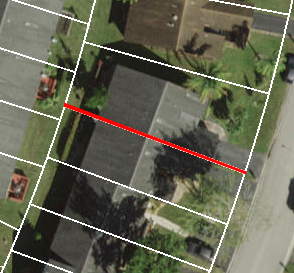

What happened? Well, take another look at the menu above the tax document. See where it says “View Map”? Click that (or just click here). You’ll see the map, below.

That red line doesn’t outline the property Mr. Holness bought. It is the property Mr. Holness bought.

If you look again at the image at the top, you’ll see a bit of grass running between the driveways. If you extend that one-foot wide lane through the two connected houses and beyond — in total, a 100-foot-long distance — you’ll end up with the parcel put up for auction. Mr. Holness didn’t buy a house. He bought that 100-foot by 1-foot strip of real estate. It was likely the byproduct of an oversight by the company which built the houses years ago — someone did a poor job describing the property lines, and as a result, the builders accidentally retained this tiny column of land (and now, a wall between two garages). They didn’t want it, they didn’t pay the buck or so each year in taxes, and ultimately, the county seized it and auction it off pursuant to local laws.

That’s ridiculous, though, and Holness — a first-time bidder on these auctions — understandably assumed that what he was buying was the house in question. He called the auction “deception,” telling the Florida Sun-Sentinel that “there was no demarcation to show you it’s just a line going through [the villa duplex], even though they have the tools to show that.” (That probably isn’t true — it looks like they did use that tool, although the line of demarcation may have been updated since the auction.) In support of his claim, he cited the picture from the assessor’s website — and probably pointed out that it’s ridiculous to have a $2,106.06 starting bid on a property with a fair market value of fifty bucks.

Unfortunately, the county has a strict “no returns” policy. Per the Sun-Sentinel, “the message from county officials and real estate experts is that auction participants need to do their homework and make sure they’ve checked for all possible problems a property might have.” That said, the county’s deed auction website now has a huge notice on the top of all its pages, screaming at potential buyers, telling them to do their research before bidding.

As for Holness’ new investment, as of last month, he’s still not sure what he’s going to do with it — but he almost certainly won’t be getting his money back.

Bonus fact: While the deal above was a (very, very) bad one, you can get some really great deals in property auctions. In 2017, a consortium of investors including Wells Fargo purchased the Galleria, a 1.1 million square foot shopping mall at auction for $100. (Yes, one hundred bucks.) Why so cheap? The mall was in foreclosure — the previous owners owed more than $140 million on the property — and Wells Fargo was the bank which put the property up for sale. And that gave Wells Fargo an advantage. Wells Fargo didn’t have to accept the winning bid if it were less than the amount owed. While that shouldn’t have precluded bids — the property is worth a lot more than $140 million — another rule sealed the deal. As the Pittsburgh Post-Gazette explained prior tot he auction, “interested bidders are required to submit a 20 percent, non-refundable deposit on their bid [before the auction]. However, Wells Fargo can also bid on the property without being on the hook for the deposit or final price tag, according to a legal notice.” The Wells Fargo consortium was the only bidder.

From the Archives: Obtuse and Acute: A very very small piece of Manhattan, held onto as a protest.