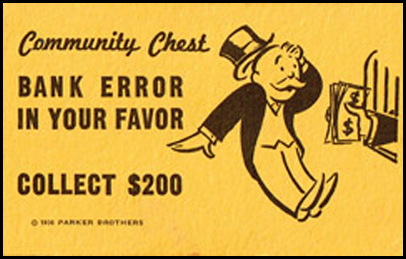

Why You Shouldn’t Take Advice From a Board Game

Monopoly, as I’ve mentioned before, is a terrible board game. The rules are complicated and often make no sense (why is going to jail, strategically, a good thing?), and the only way to win regularly requires you to be an absolute jerk and bad sport. And as it turns out, it gives bad advice, too. For example, there’s the card pictured above. The player who draws it gets $200 from the bank, and in order to add a little more realism to the game, they add some flavor text: you’re getting that cash because of a “bank error in your favor.”

In Monopoly, you just do what the card says — take the money and run. But is that good advice for real life? What happens if a typo makes you suddenly rich?

In 2018, Samsung Securities — a Korean investment management firm (which, yes, shares branding with the makes of TVs and cell phones) — issued a dividend to about 200 employees who participated in the company’s employee stock ownership plan. The dividend was supposed to be ₩1,000 per share owned; at the time, that came to about $0.90 USD per share; some beneficiaries were looking at bonuses of a few hundred dollars.

But someone screwed up. Instead of issuing a ₩1,000 per share dividend, the person in charge of hitting that button issued a 1,000 share per share dividend. As the Korea Herald reported, “the value of dividends offered to employees due to the ‘fat-finger’ slip-up came to 112.6 trillion won (about $100 million), over 40,000 times the intended value and 33 times greater than the company’s market cap.” Suffice it to say that, if the company couldn’t reverse the error, the company would cease to exist once these 200 or so employees sold these phantom shares.

So, of course, Samsung Securities canceled the shares as quickly as they could. But that didn’t happen right away — they needed to notice the error, first. That happened quickly; about 37 minutes after the shares were issued, Samsung did exactly that. But during that short gap, 21 employees tried to sell their accidentally-gotten shares. Sixteen were successful in doing so, becoming instant millionaires.

And then, their luck turned.

Samsung Securities fired all 21 employees as quickly as possible; for comparison’s sake, those directly responsible for the error were reprimanded but, apparently, not fired. For the sixteen who made out with as much as $9 million apiece, that probably wasn’t a big deal — the payday mitigated the damage of losing their job. But their story wasn’t over. As Reuters reported, public outcry was intense; within a few days of the error, “more than 200,000 people [had] signed a petition on the presidential Blue House’s website, calling for employees who sold off the shares to be severely punished.” And that 200,000 was a magic number; per another Korea Herald report, when such petitions reach that mark, “the presidential office and other government agencies related to the issue will look over the case.”

The government found ways to frame these sales into criminal activity. Arguing that the employees really should have known better (and let’s face it, they should have), the authorities were able to recoup the millions of dollars generated from these stock sales. Ultimately, four of the sixteen who sold their shares were arrested and charged with embezzlement. Most likely, they paid a fine and didn’t serve any prison time (which is probably the just outcome, but makes it hard to make a “Bank Error in Your Favor: Go Directly to Jail” joke here.) But regardless, Samsung Securities’ error wasn’t ultimately a good one for them: they ended up being neither millionaires nor, for that matter, employed.

Bonus fact: In 1966, the FBI captured a man named James Robert Ringrose, who had spent about a year on the Bureau’s most wanted list for passing bad checks. When they apprehended him, he gave them a present — a “Get Out of Jail, Free” card from Monopoly. It didn’t work.

From the Archives: Onion Ring: Market manipulation — but legal!