Who is MP and Why Are His Initials on My Checks?

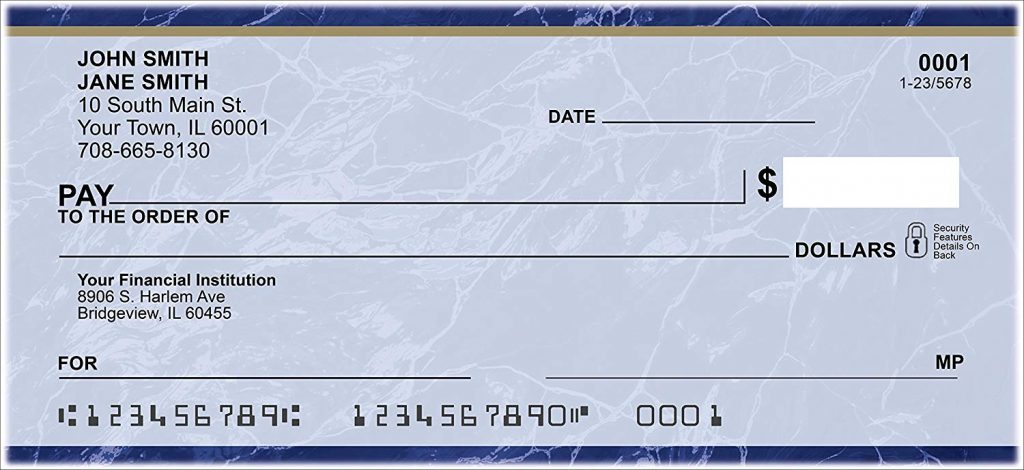

Pictured above is an example of a personal check as often seen in the United States. Most of the features should be familiar. The account holder’s name, address, and phone number are in the upper left; the check number (and some other numbers below it, typically identifying the bank and branch where the account sits) are in the upper right. The bank’s address is middle-left, and at the bottom are three numbers: the account number, the routing number, and again, the check number. And then there are some lines and spaces for you, the check writer, to fill in some information.

Oh, and then there’s our mystery: the initials “MP,” positioned to the right of the signature line. Who is MP, and why are his initials on our checks?

To keep us safe, of course.

When it comes to financial transactions, we want to make sure the documents we use are genuine. As a result, banks and treasuries alike have invested in developing new ways to prevent counterfeit checks and currency from getting passed around. When it comes to currency, there’s a lot the treasury can do, including using special paper and ink which average consumers simply can’t use. Checks, though, are a bit harder to police, because, by design, they’re intended to be used once and only once. We’re left with cheaper options to prevent fraud.

That’s where MP comes in. That signature line? If MP is there, the line isn’t a line at all. If you look very closely, you may notice that it seems thinner than the other lines and may even appear a bit blurry. If we zoom in, we’ll see why: the “line” is actually made up of words, typically “Authorized Signature” or “Genuine.” You’ll need to magnify if to see it, but here’s an example.

Those words appear via a technology called “microprinting,” or — you guessed it — MP, for short. The printer made to create the checks writers is able to create very, very small letters which are impossible to read with the naked eye. And more importantly, most of the copying tech out there can’t reproduce it; as Intuit Quickbooks explains, microprint is “extremely tough to reproduce using a photocopier or scanner.” Instead of getting “Authorized Signature” over and over again, you get a blurry line which remains blurry when magnified.

Not all personal checks have this, though; because checks with microprinting are a bit more expensive to create, banks don’t always provide them to their customers. As a result, banks need a way to know if any given check has this security feature. So, they simply add an “MP” to the signature line if microprinting is present, letting the receiving bank know to magnify if necessary.

Bonus fact: Microprinting can have another advantage: it can be used to add some culture to your currency. In 1993, Australia added some microprinting to its ten-dollar bill as a security measure, but they also had some fun with it along the way. The bill, seen here, featured Banjo Patterson (1864-1941), a poet famous for his lyrical descriptions of the Australian bush regions. Behind Patterson’s profile is a square filled with microprinting. If you zoom in on the words that the Reserve Bank of Australian chose, you’ll get to know Patterson a bit better. As seen here, the microprinted words are a poem he wrote, titled “The Man from Snowy River.” (The bill was updated in 2017, and newer ones do not have this feature.)

From the Archives: Paper Trail: If you do photocopy checks and pass them off as real (and please, don’t do this), your photocopier may be a witness against you — because some of them leave fingerprints.