Making Light Work of Wall Street

The distance from New York to Chicago is about 700 miles (about 1,125 km). It’s close enough so that two people having a phone conversation — one in New York and one in Chicago — can feel like they’re standing right next to one another, conversing with and interrupting each other without any sense of distance. But in reality, it takes a teeny tiny bit of time for those sounds (converted into electrical impulses, which travel even faster than sound) to make their way across the distance. Let’s use the speed of light instead — in a vacuum, it’s going to take light about 3.7 milliseconds for a photon to make the trip. Double that to account for the fact that any such trip is going to take place in a non-vacuum and you’re at about 7 milliseconds. That’s still super fast, but it’s not quite zero.

Practically speaking, though, how long it takes for light to travel from New York to Chicago is almost never a relevant concern. But when it does matter, it can also help us detect some potentially shady dealings.

In 1998, the U.S. Securities and Exchange Commission (“SEC”) gave the go-ahead to create electronic exchanges, allowing for stock, bonds, and commodities markets in which algorithm-informed computers make trades without the intervention of a human trader. If, for example, a computer program determines that some breaking news will cause the price of frozen concentrated orange juice to rise, that computer can initiate a trade to buy some now, before prices go up. All this can happen without a person making sure the computer is doing the right thing.

Since then, many financial firms have engaged in something called “high-frequency trading,” making very large amounts of short-term moves. The basic idea is that the computer detects a likelihood of a (typically tiny) temporary uptick in an asset’s value, buys the stock/bond/whatever, and then quickly dumps the slightly-more-valuable whatever-it-was. The trick is to move quickly — the earlier you get in on the trade, the more likely someone else will be around to be on the other side of the transaction when you want to sell.

In order to move as fast as possible, many of these firms have invested in something called “ultra-low latency direct market access.” You can click that link to read more about it, but effectively, it’s tech which gives traders direct access to the relevant markets at very very very high speeds, approaching (but obviously not exceeding) the speed of light. This odd intersection of finance and tech has led to what some have called an “arms race,” hoping to be the fastest of the fast.

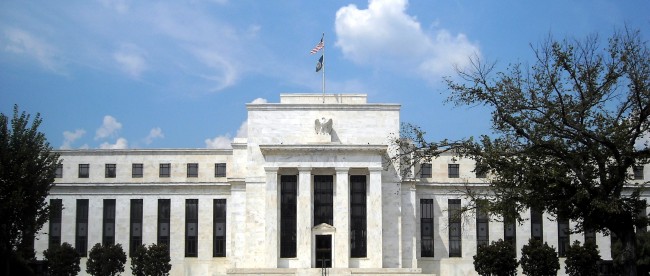

But on September 24, 2013, the Federal Reserve (better known as the Fed) announced that someone may have gone a bit too fast. At 2 PM on Wednesday before, the Fed made an announcement that surprised many traders, and the resulting news caused an uptick in, among other things, gold prices. And 2 PM meant 2 PM. The Fed invited financial reporters to a secure room in New York City and, per CNBC, “instructed [the] reporters not to send information about that decision to the outside world before precisely 2 p.m. as measured by the national atomic clock in Colorado.”

Once the news hit, the high-frequency traders kicked into action — and, by design, that meant trades started hitting in the blink of an eye. But someone appeared to blink too quickly. The Washington Post explained:

Somebody placed massive orders for gold futures contracts betting on exactly that outcome within a millisecond or two of 2 p.m. that day — before the seven milliseconds had passed that would allow the transmission of the information from the Fed’s “lock-up” of media organizations who get an early look at the data and the arrival of that information at Chicago’s futures markets (that’s the time it takes the data to travel at the speed of light. A millisecond is a thousandth of a second). CNBC’s Eamon Javers, citing market analysis firm Nanex [available here], estimates that $600 million in assets could have changed hands in that fleeting moment.

There would seem to be three possibilities: 1) Some trader was extraordinarily lucky, placing a massive bet just before a major announcement that would make that bet highly profitable. 2) There was a leak, either by a media organization with early access to the data or even someone at the Fed. Or 3) The laws of physics have been violated as the information traveled from Washington to Chicago faster than the speed of light.

Finding the first option foolish and the third option unrealistic, the Fed decided to look into the mess. Unfortunately, the results of that investigation have gone unreported and it’s unclear what the Fed concluded. Perhaps the Fed, the speed of light is only a theoretical barrier — but, well, one hopes not.

Bonus Fact: There are lots of stars in the sky, so it’s hard to say which is the largest, but a star named UY Scuti is often considered the largest. The star is so big that, per Wikipedia, “a hypothetical object traveling at the speed of light would take about seven hours to travel around UY Scuti.” To give some context, something moving at the speed of light would require only 14.5 seconds to travel around the Sun.

From the Archives: Onion Ring: The main story is about some neat financial shenanigans. The bonus item hits upon some insider trading, but in an acceptable way.

Take the Quiz: There are twelve branches of the Federal Reserve. Name the cities they are in.

Related: “Flash Boys: A Wall Street Revolt” a book on high-frequency trading by famed financial novelist Michael Lewis. 4.5 stars on more than 3,000 reviews.